Amara Raja’s Revenue Up 4.2% in Q3 Due to Strong EV Market Growth

The company’s PAT, however, declined by 53.03% in Q3 FY 2026

February 13, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

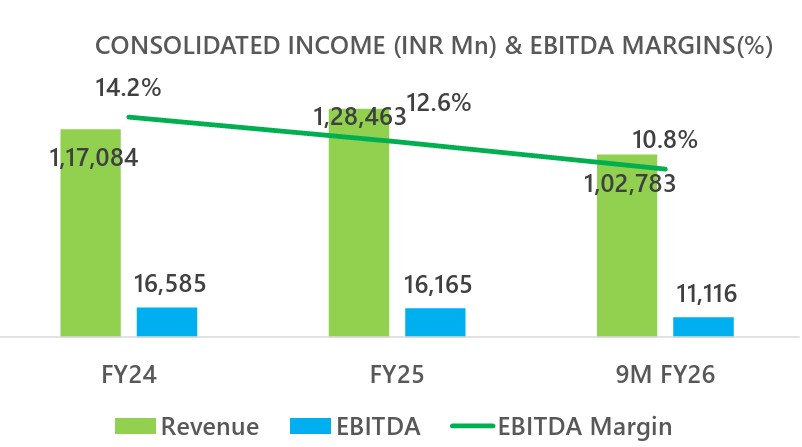

Battery manufacturer Amara Raja Energy and Mobility posted a revenue of ₹34.1 billion (~$376.14 million) in the third quarter (Q3) of the financial year (FY) 2026, a 4.21% year-over-year (YoY) increase from ₹32.72 billion (~$360.95 million).

Its new energy business crossed the ₹2 billion (~$22.06 million) revenue mark in the quarter.

The company reported healthy performance across key segments, led by strong automotive growth driven by rising original equipment manufacturer volumes, particularly in the domestic four-wheeler and allied segments.

Revenue from lubes reached ₹500 million (~$5.52 million) during the quarter.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled ₹3.74 billion (~$41.26 million), down 7.88% YoY from ₹4.06 billion (~$44.78 million) in Q3 FY 2025.

Profit after tax (PAT) stood at ₹1.4 billion (~$15.46 million), declining 53.03% YoY from ₹2.98 billion (~$32.91 million).

Earnings per share (EPS) came in at ₹7.66 (~$0.084) compared to an EPS of ₹16.3 (~$0.180) in Q3 FY 2025.

9M Results

Amara Raja reported revenue of ₹102.78 billion (~$1.13 billion) in the first nine months (9M) of FY 2026, a 5.03% YoY increase from ₹97.86 billion (~$1.08 billion).

EBITDA stood at ₹11.12 billion (~$122.66 million), decreasing 12.85% YoY from ₹12.76 billion (~$140.75 million).

PAT was ₹5.81 billion (~$64.13 million), declining 25.75% YoY from ₹7.83 billion (~$86.40 million).

The company’s EPS came in at ₹31.77 (~$0.350) compared to ₹42.79 (~$0.472) in 9M FY 2025.

Business Highlights

As of Q3, Amara Raja currently has 14 manufacturing facilities. The company has approximately 66 million units of annualized automotive battery manufacturing capacity and approximately 2.5 billion AH of industrial battery manufacturing capacity.

The company has a ~1.2 GWh pack assembly plant in Tirupati, Andhra Pradesh, a ~1.5 GWh pack assembly plant in Divitipally, and an AC/DC charger assembly plant in Tirupati.

In the lead-acid battery segment, the company has manufacturing plants for two- and four-wheeler batteries, as well as low-voltage valve-regulated lead-acid batteries, in Karakambadi, Andhra Pradesh.

It has manufacturing facilities for two 4W plants and one 2W plant, a medium-voltage valve-regulated lead-acid battery, and a tubular plant.

Amara Raja also has a 150,000 MTPA battery recycling plant in Cheyyar, Tamil Nadu, which is expected to be operational by Q4 FY 2026/Q1 FY 2027.

It also has an over 1.5 million battery/annum advanced tubular manufacturing plant, which has been operational since Q1 FY 2026.

Amara Raja has proposed to set up a 16 GW cell manufacturing plant by FY 2030. It is expected to be partially commissioned by 1H 2027, with 2 GWh of manufacturing capacity operational.

During Q3. Amara Raja infused ₹2 billion (~$22.06 million) into ARACT, its wholly owned subsidiary.

The company also plans to establish a 5 GWh battery energy storage solution manufacturing plant.

Its UPS volumes also rose by 5% in the quarter.

The company saw a decline in lead-acid volumes in the telecom segment as lithium solutions take over the market.

The company also saw a decline in exports due to ongoing geopolitical tensions impacting global trade flows.

Vikramadithya Gourineni, Executive Director (New Energy Business) at Amara Raja, said that the company is making progress in establishing its customer qualification plant and research and development plant.

He said the operation of these facilities will allow Amara Raja to supply India-made cells to customers for testing early in the next financial year.

Recently, Amara Raja announced plans to incorporate a wholly owned subsidiary in the U.S., to be named “ARE&M US Inc.”

In Q2 of FY 2026, the company posted a revenue of ₹34.67 billion (~$390.85 million), a 6.7% YoY increase from ₹32.5 billion (~$366.46 million).