Higher Wind Installations Push Inox Wind’s Revenue Up by 33% YoY in Q3

The company’s revenue rose by 38% YoY in 9M FY 2026

February 18, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Wind energy solutions provider Inox Wind (IWL) reported revenue of ₹12.07 billion (~$133.13 million) in the third quarter (Q3) of the financial year (FY) 2026, a 32.5% year-over-year (YoY) increase from ₹9.11 billion (~$100.47 million).

The company posted its strongest Q3 performance in FY 2026.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) also rose 38.5% YoY to ₹3.13 billion (~$34.52 million) from ₹2.26 billion (~$24.92 million).

The company’s quarterly net profit rose by 14.4% YoY to ₹1.27 billion (~$14 million) from ₹1.11 billion (~$12.24 million).

IWL’s earnings per share (EPS) came up to ₹0.73 (~$0.008) compared to an EPS of ₹0.69 (~$0.008) in the corresponding quarter last year.

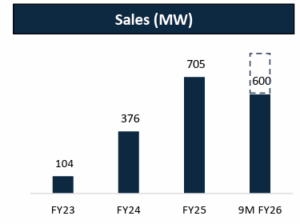

The company’s quarterly wind installations increased by 33.3% YoY to 252 MW compared to 189 MW in the corresponding quarter last year.

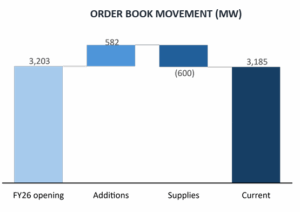

As of December 31, 2025, the company’s order book stood at 3,185 MW. Currently, IWL’s order book is being split nearly equally between turnkey solutions and equipment supply.

In Q2 of FY 2026, Inox Wind reported a revenue of ₹11.62 billion (~$131.12 million), a 56% YoY increase from ₹7.44 billion (~$83.95 million).

9M Results

IWL reported revenue of ₹31.53 billion (~$347.60 million) in the first nine months (9M) of FY 2026, a 38% YoY increase from ₹22.82 billion (~$251.70 million).

Its EBITDA rose 42% YoY to ₹8.04 billion (~$88.66 million) from ₹5.65 billion (~$62.30 million).

The net profit for 9M FY 2026 stood at ₹3.45 billion (~$38.05 million), up 39.7% YoY from ₹2.47 billion (~$27.24 million).

IWL’s EPS increased to ₹1.99 (~$0.022) in 9M FY 2026 compared to an EPS of ₹0.16 (~$0.002).

The company’s wind installations for 9M FY 2026 stood at 600 MW, a 28% rise from 469 MW in the same period last year.

Operational Highlights

As of Q3 FY 2026, IWL operates five manufacturing plants in Gujarat, Madhya Pradesh, and Himachal Pradesh, where blades, tubular towers, hubs, and nacelles are manufactured. With its 3 MW WTG series, IWL’s manufacturing capacity stands at approximately 2.5 GW per annum.

Inox Wind is ramping up new nacelle and hub plants, a transformer manufacturing facility, and crane services.

The company is also planning to establish a new blade and tower manufacturing unit in Karnataka and launch 4X MW units by 2026.

Inox Renewables Solutions has executed over 3 GW of projects across India, with ongoing engineering, procurement, and construction activities in multiple states.

IWL’s operations and maintenance (O&M) subsidiary, Inox Green, has an O&M portfolio of approximately 13.3 GW, comprising about 10 GW of wind and 3.3 GW of solar.

The company is in the process of demerging its substation business from Inox Green and merging it with Inox Renewable Solutions. Post-merger, Inox Renewable Solutions will be listed on the stock exchanges.

Inox Clean Energy, the renewable arm of INOXGFL, has set a target of executing 3 GW of hybrid independent power producer projects annually.

During the Q3 FY 2026 earnings call, Mathusudhana SK, CEO at Inox Green, noted that the company sees considerable market potential in the business of overhauling existing wind turbine generators.

Inox said more states are entering the wind market. Earlier, only Gujarat, Maharashtra, and Karnataka were active in wind development, and Rajasthan and Andhra Pradesh are also exploring opportunities.

Outlook

IWL said that its strong growth guidance for FY 2026 and FY 2027 is supported by its large, well-diversified order book.

For FY 2026, the company projects consolidated revenue of over ₹50 billion (~$551.15 million), translating to more than 35% YoY growth, while EBITDA margin guidance has been upgraded to 20–22% from 18–19% earlier.

Looking ahead to FY 2027, Devansh Jain, Executive Director of INOXGFL Group, said that Inox Wind will continue to deliver strong performance and execution, while Inox Green’s large-scale O&M portfolio expansion will further enhance consolidated profitability.