REC Silicon Narrows Net Loss by 94% in Q4 2025 Despite Revenue Decline

The company’s revenue declined by 44.46% YoY in 2025

February 16, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Norway-based silicon materials manufacturer REC Silicon reported a net loss of $17.3 million in the fourth quarter (Q4) of 2025, narrowing 94.48% year-over-year (YoY) from a net loss of $313.5 million.

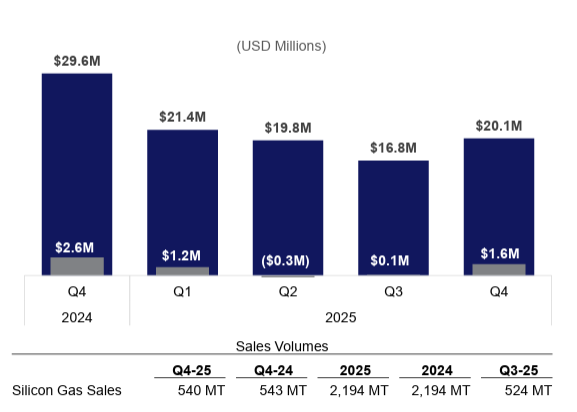

Revenue declined 32.32% YoY to $20.1 million from $29.7 million in the corresponding quarter last year.

The company’s earnings before income, taxes, depreciation, and amortization (EBITDA) loss narrowed 30.19% YoY to $3.7 million from $5.3 million in Q4 2024.

The Butte facility contributed $1.6 million to the company’s EBITDA in Q4 of 2025, compared to $100,000 in the previous quarter.

Despite the shutdown of polysilicon production capacity at the Butte facility in mid-2024, a limited amount of polysilicon continues to be produced to analyze silicon gas quality.

REC Silicon reported earnings per share (EPS) loss of $0.04, compared to an EPS loss of $0.75 in the same quarter last year.

Full-Year Results

For the full year 2025, REC Silicon posted a net loss of $63.1 million, narrowing 86.21% YoY from $457.4 million.

Revenue declined 44.46% to $78.2 million, compared to $140.8 million in the previous year.

The company’s EBITDA loss narrowed 40.22% YoY to $10.7 million, from $17.9 million in 2024.

Its EPS loss stood at $0.15, compared to $1.09 in the prior year.

Business Highlights

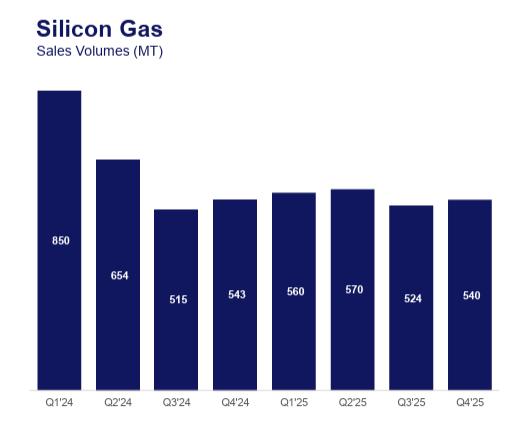

Silicon gas sales volumes increased by 16 MT to 540 MT during Q4 of 2025 compared to the previous quarter of the same year.

Sales prices for silicon gas increased by 17.6% from the previous quarter, primarily due to changes in the product mix.

Total polysilicon sales volumes, including by-products, were 150 MT in Q4 of 2025, compared to 38 MT in the previous quarter.

During the quarter, sales volumes of other-grade polysilicon increased by 110 MT to 140 MT, driven by the selling down of previously produced lower-grade material.

In Q4, REC Silicon also reported a gain of $1.4 million from the sale of previously produced granular polysilicon, as proceeds exceeded the carrying value of inventory.

The company also finalized $20 million short-term loans from Anchor AS and secured an additional $10 million short-term loan from it.

REC Silicon also secured a $110 million short-term loan agreement with Hanwha International.

Despite REC Silicon permanently shutting down its granular polysilicon operations in Moses Lake, the company incurred $3.9 million in the quarter to sustain safe and reliable operations going forward.

President and CEO at REC Silicon, Kurt Levens, noted that the company requires additional financing and support, particularly from its major shareholder, to fund its ongoing operations.

In this regard, the company has also proposed a fully underwritten rights issue to raise the $100 million in new equity.

During Q4, REC Silicon reported a $1.3 million gain in other income and expenses, primarily due to changes in asset retirement obligations at the Moses Lake facility.

During the quarter, the company recorded an impairment loss of $4.5 million following asset reviews conducted at the Butte facility. However, this was partially offset by a $2.4 million gain from discontinued operations related to Moses Lake, primarily due to the successful renegotiation of a long-term lease.

REC Silicon plans to fully utilize the 7,400 MT silane gas capacity at Butte to manufacture silane and specialty gases. The Butte facility also supplies monosilane for the silicon anode battery industry.

The Moses Lake facility has an annual capacity of 24,000 MT of silane gas, which the company uses for captive consumption.

2026 Outlook

REC Silicon expects silicon prices to reach 550-600 MT in Q1 of 2026.

The company said that it is studying how to comprehensively restructure the $450 million term loan maturing in 2026.

Levens said that silicon gas sales remain relatively range-bound in 2026, although some segments are now showing signs of recovery.

However, he added that geopolitical tensions and market oversupply have led to inventory imbalances across the value chain and reduced market visibility.

In Q2 of 2025, REC Silicon reported a revenue of $19.9 million, an 83% YoY decline from $36.4 million.