Global Lithium-Ion Battery Market Surpassed $150 Billion in 2025: IEA

Electric vehicles were the largest driver of lithium-ion battery deployment

February 20, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The global lithium-ion battery market exceeded $150 billion in 2025, up 20% from 2024, according to an International Energy Agency (IEA) report.

The report noted that declining battery costs and the expansion of applications continue to drive rapid demand growth across multiple sectors.

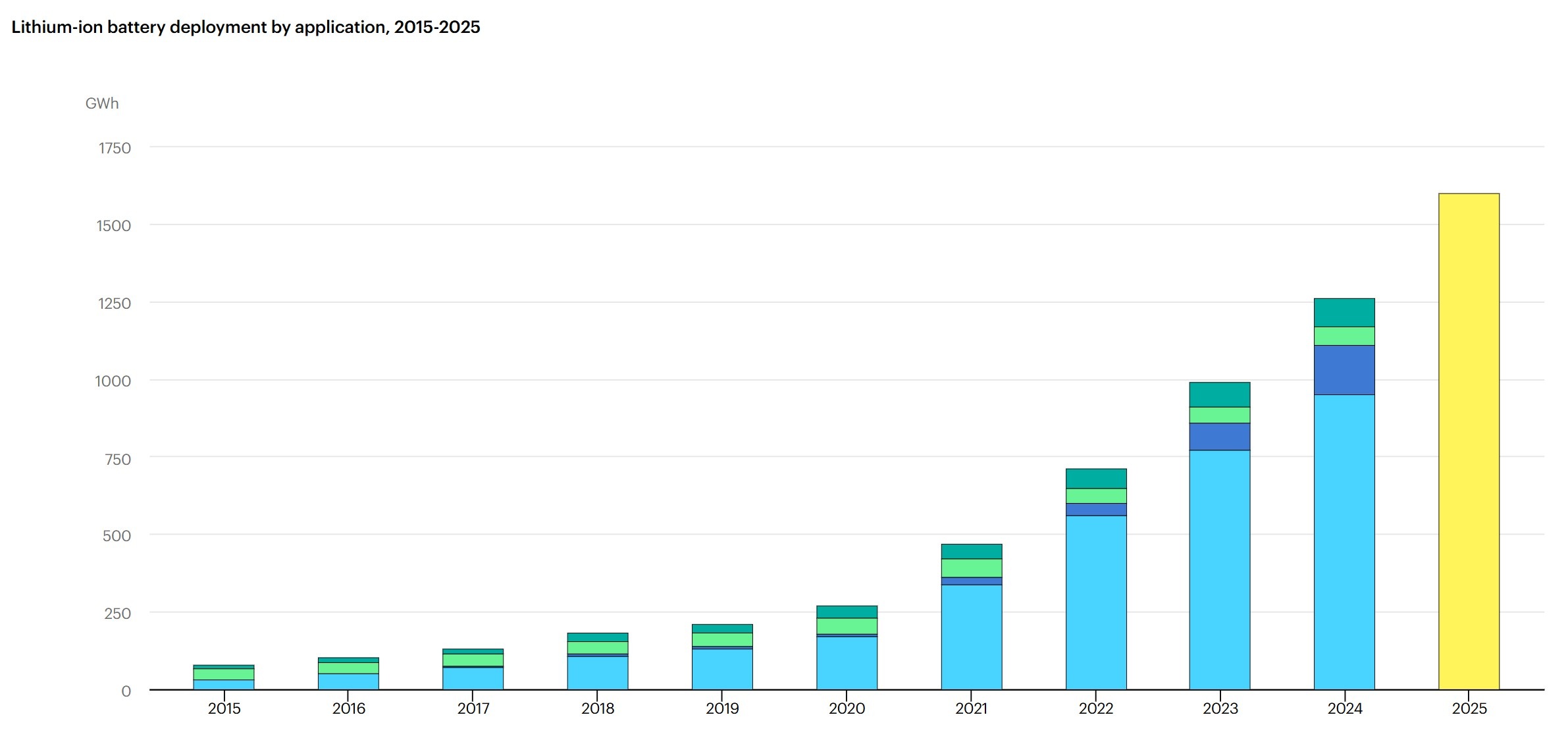

Global lithium-ion battery deployment in 2025 was six times higher than in 2020.

Electric vehicles (EVs) remained the dominant demand driver, accounting for more than 70% of total lithium-ion battery deployment. After EVs, demand was driven by the growth of battery energy storage systems (BESS), which accounted for about 15% of the market.

This represents a sharp shift from a decade ago, when nearly half of global battery demand came from portable electronics.

According to a McKinsey & Company report, demand for lithium-ion batteries exceeded 1 TWh in 2024 and nearly 1.6 TWh in 2025.

Falling Battery Prices

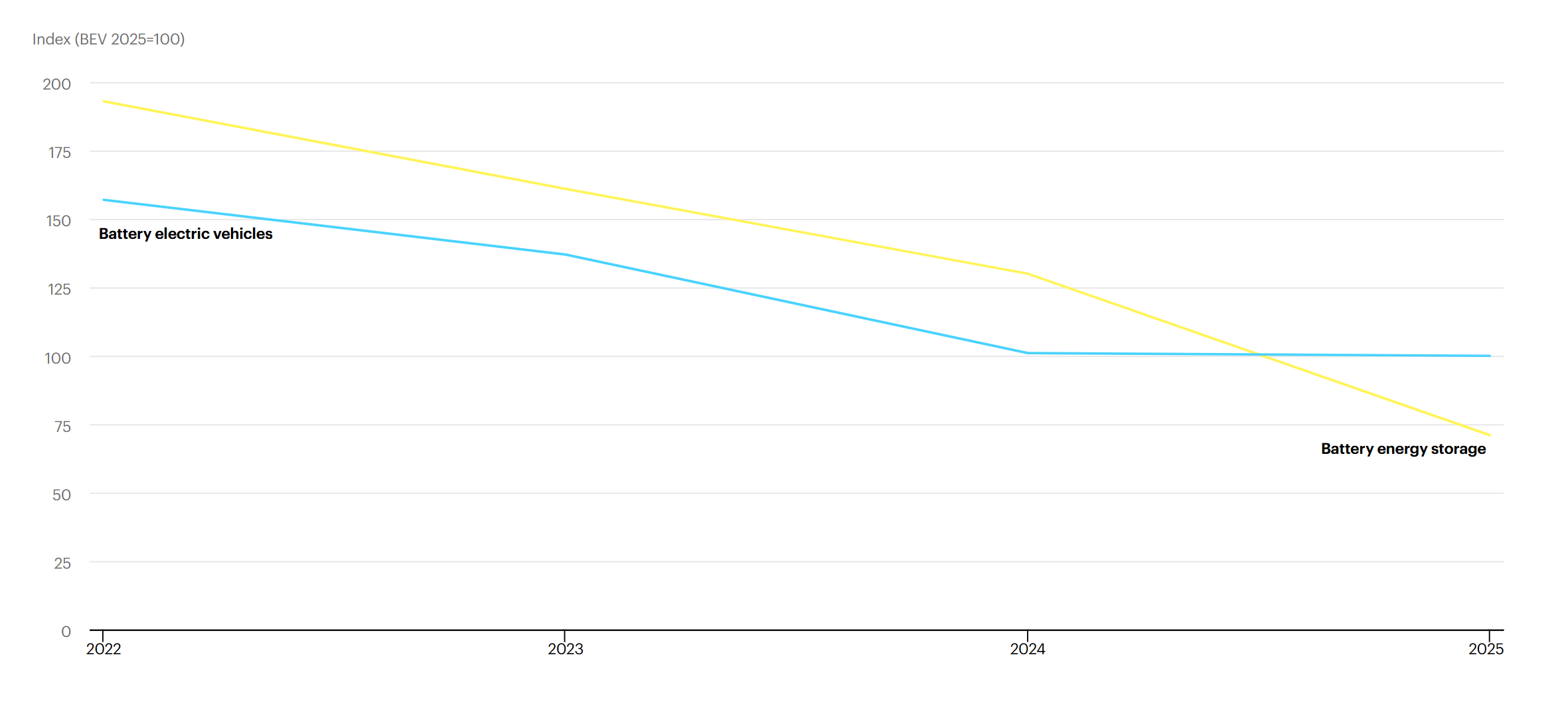

In 2025, average battery prices declined by 8%, supported by advances in manufacturing, improvements in battery chemistries, and intensifying global competition.

BESS saw the steepest price drop, with average global prices in 2025 falling to one-third of 2020 levels.

Battery pack prices in China were 30% lower than in the U.S. and 35% lower than in Europe.

Record-low lithium iron phosphate (LFP) battery prices also contributed significantly to overall cost reductions. LFP prices fell by more than 15%, compared with less than 5% for lithium nickel cobalt manganese oxide (NMC) batteries. As a result, LFP batteries were on average more than 40% cheaper than NMC alternatives.

Consequently, LFP accounted for over half of EV batteries and more than 90% of batteries used in energy storage systems globally.

While LFP batteries benefit from lower material costs, concerns are growing about the sustainability of current prices. Many LFP cathode producers are operating at a loss, raising the likelihood of market consolidation.

Deployment of LFP batteries also remains heavily concentrated in China, but uptake is expanding rapidly in emerging and developing economies.

LFP batteries now power well over half of all electric car sales in emerging and developing economies, up from 2023’s double that share.

Growth of BESS

BESS deployment has grown exponentially, with global installations increasing more than twentyfold in storage capacity over the past five years.

As variable renewable energy generation expands across markets, battery storage is positioning itself as a critical source of flexibility and resilience for power systems, while also representing a growing commercial opportunity for manufacturers.

More than 90% of battery storage applications rely on LFP batteries, which are almost exclusively supplied from China. The country accounts for nearly all global manufacturing capacity and associated technical expertise.

Korean producers are ramping up investments in LFP production to build an alternative supply base. However, the report highlighted that they face intense competition from established, lower-cost Chinese manufacturers in an oversupplied market.

Concentration of Battery Supply Chains

Chinese, Korean, and Japanese companies dominate global lithium-ion battery cell production, accounting for nearly all global output.

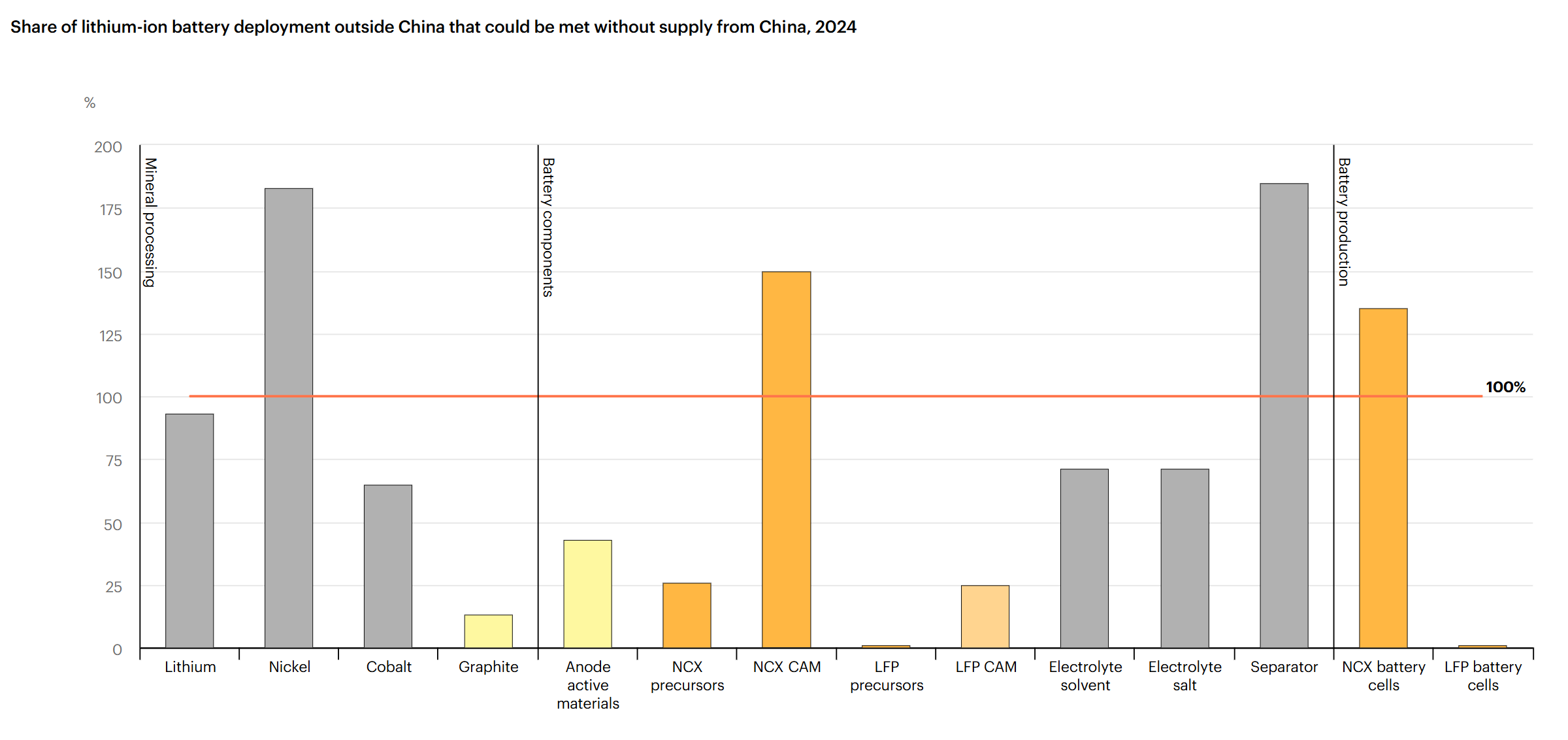

China leads by a wide margin, manufacturing well over 80% of all batteries in 2025. The European Union and the U.S. account for most of the remaining output, each contributing a similar share. Battery factories in these markets rely heavily on imports for most battery components, primarily from China. The limited investment in midstream supply chains in these regions poses a growing risk to global supply security.

The production capacity and technical expertise for battery manufacturing remain highly concentrated in China.

Korea and Japan are the only other countries with notable midstream battery industries, offering some diversification opportunities.

Nearly all batteries used for grid-scale applications depend on China for at least one step in their supply chain.

Additionally, over 70% of electric vehicles produced outside China rely on batteries or battery components sourced from China.

Last year, China announced new export control measures on multiple components used in the manufacturing of lithium-ion batteries and cathode materials, according to the country’s Ministry of Commerce and the General Administration of Customs.